VI. Core Industry Divergence: The Widening Format Divide

This isn’t just about good sales versus bad sales; it’s about a fundamental, structural separation in how consumers are choosing to interact with written content.

A. The Structural Separation Between Digital and Physical Performance

The September 2025 data paints a clear picture of a publishing industry experiencing a pronounced bifurcation of consumer behavior. While the overall industry revenue climbed substantially for the month, this growth was almost entirely propelled by the exceptional showing in print (up double digits), which directly balanced the simultaneous underperformance in the digital sphere (e-books down nearly 8%). This growing disparity is the central structural narrative of the current moment, indicating that readers are making distinct format choices based on the type of content or the reading occasion.

B. Reader Habits Influencing Format Preferences. Find out more about e-book revenue decline September 2025.

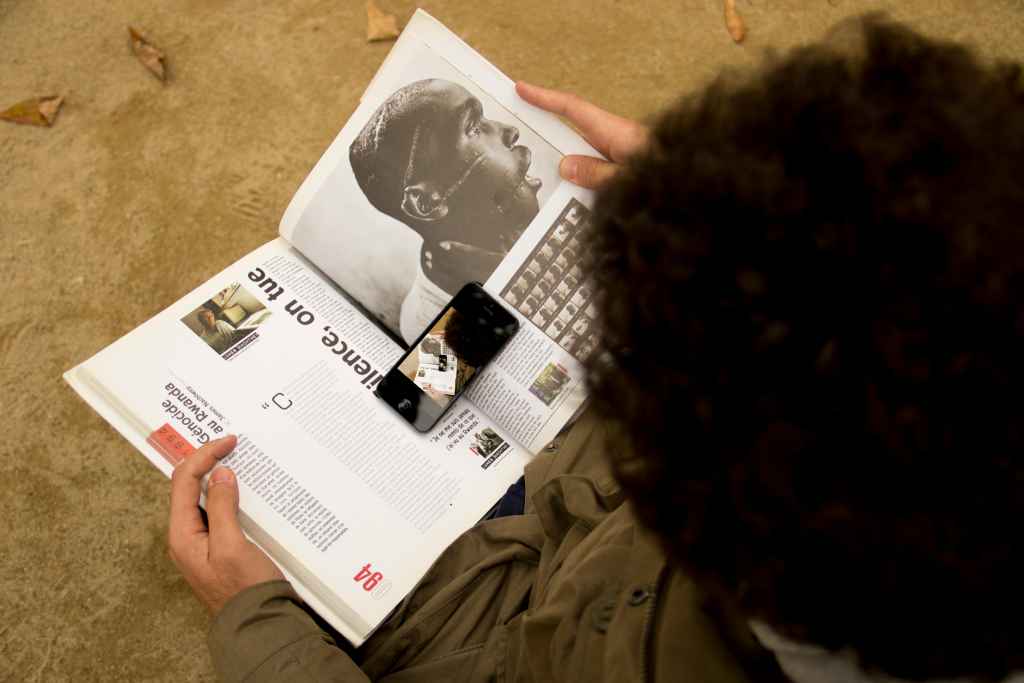

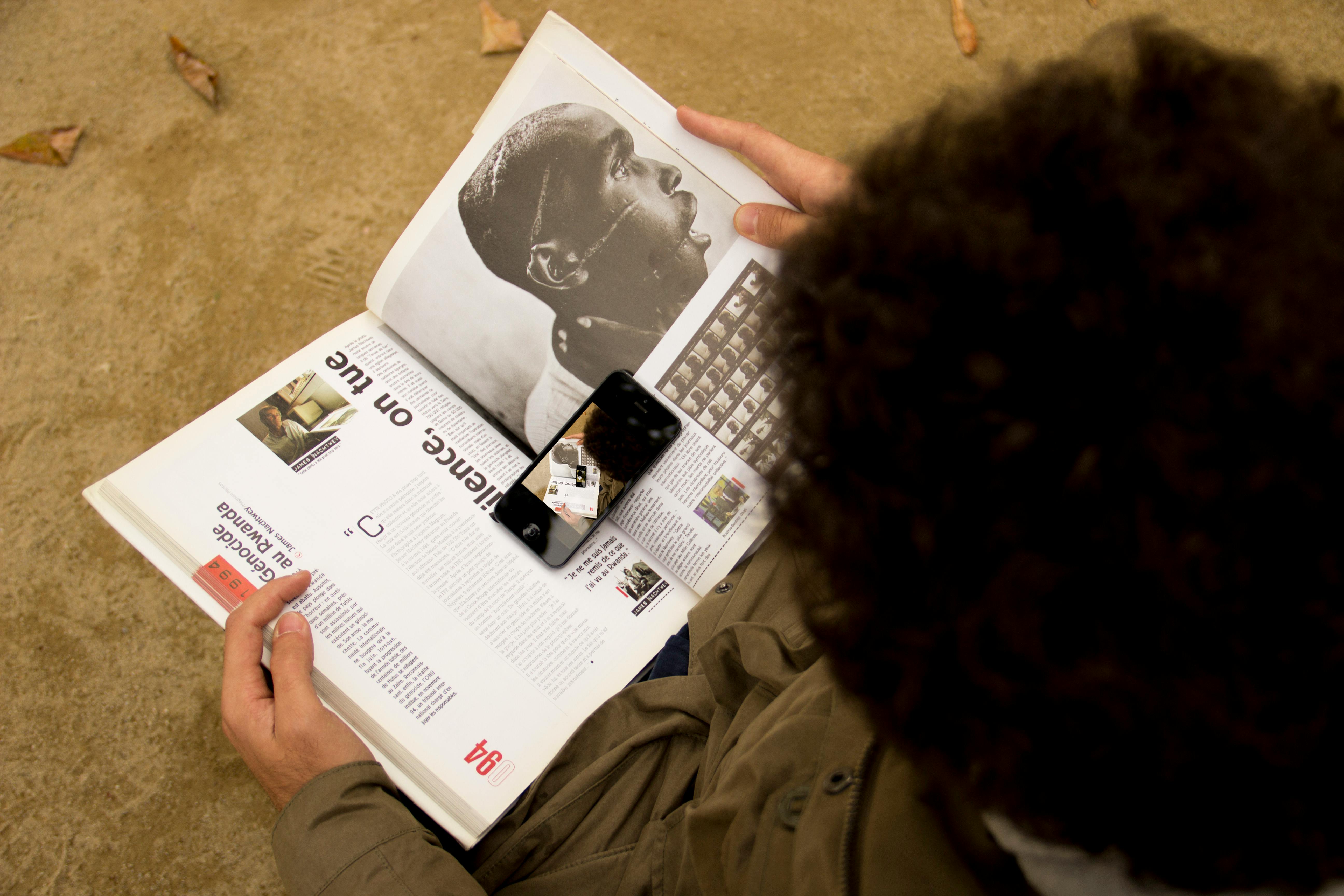

This divergence strongly suggests an evolving set of reader expectations the digital sector is currently failing to satisfy. The renewed enthusiasm for the physical object implies a value proposition—perhaps related to focus, screen fatigue, or tactile engagement—that digital alternatives have not yet overcome. Conversely, the continued, though slowing, adoption of audiobooks suggests a preference for multi-tasking or consumption during transit, areas where digital remains superior. Think about your own commute: are you scrolling, or are you listening? The format choice now seems less about loyalty and more about utility.

VII. Broader Market Context and Economic Indicators

The reading choices people make aren’t happening in a vacuum. Economics, technology, and even politics play a role in what lands on our nightstands—or in our earbuds.

A. The Influence of Economic Factors on Publishing Expenditures

Any comprehensive analysis must account for the prevailing economic climate of the year. While the overall market captured a significant revenue total in September, the preceding year-to-date softness suggests that consumers may be exercising greater price sensitivity or shifting their overall entertainment budgets. The willingness to spend robustly on print might indicate a search for perceived greater value or permanence in a physical product versus a digital file or subscription service. When the budget gets tight, people might be deciding that a beautiful hardcover is a better keepsake than a transient digital license.. Find out more about e-book revenue decline September 2025 guide.

B. The Role of New Device Ecosystems and Platform Updates

Technological evolution within the reading hardware space also plays an indirect role. Continuous updates to e-reader software, the introduction of new color screen devices, and the integration of purchase functionalities directly within reading applications are all factors meant to stimulate digital spending. The fact that the e-book segment still declined suggests that the benefits derived from these platform improvements are currently being outweighed by other negative forces or simply are not driving sufficient new purchasing volume. For a look at how the hardware itself is evolving to keep pace, check out this review of 2025’s most enjoyable E Ink devices.

VIII. Future Implications and Areas for Continued Scrutiny

So, where does this leave us heading into the crucial holiday quarter? The roadmap for 2026 hinges on how publishers respond to these clear signals.

A. Challenges to the Traditional Electronic Book Model. Find out more about e-book revenue decline September 2025 tips.

The four consecutive monthly declines for e-books compel industry stakeholders to question the fundamental economic and user-experience model of current digital text delivery. If the format cannot maintain growth during a generally strong reporting period for the overall industry, it suggests deeper systemic issues regarding pricing, discovery, or the overall appeal versus a printed counterpart. The sustained softness indicates a market in need of significant innovation or a fundamental recalibration of consumer expectations. For a look at the larger business side of this, you can review the latest intelligence on Publishing Industry Financial News.

B. The Need for Digital Format Adaptation and Re-engagement

Moving forward, the key question for the digital publishing sector is how to recapture reader interest and translate the high engagement seen in platforms like online book clubs and communities into tangible sales. This will require more than incremental improvements; it may necessitate exploring novel interactive elements, alternative pricing structures, or better integration with other forms of digital media consumption to justify the purchase over a physical copy. Perhaps the digital product needs to offer a utility that print simply cannot match, rather than just offering portability.

C. The Enduring Appeal of Tangible Literature

The data unequivocally confirms that the physical book remains a deeply valued format, delivering substantial, tangible revenue streams that other segments cannot yet match. The robust performance of both hardcovers and trade paperbacks underscores a consumer desire for a dedicated, distraction-free reading experience that the physical medium inherently provides. Future industry strategy will likely need to pivot to better serve and monetize this enduring preference for the tangible. For authors and agents, this means prioritizing high-quality print editions remains a non-negotiable element of a successful launch strategy. You can see how authors are adapting to these shifts in the latest industry analysis from Jane Friedman’s Newsletter.

D. The Volatility of Niche and Legacy Formats

The dramatic collapse of physical audio (down over 40% in September) and the stagnation of mass-market print serve as cautionary tales regarding legacy formats that fail to successfully transition their value proposition into the modern digital landscape. These sharp drops demonstrate how quickly entire revenue streams can evaporate when consumer preference decisively shifts to more convenient or feature-rich alternatives, a process that other segments in publishing must actively work to avoid repeating.

E. The Comparative Stability of Digital Audio as a Digital Benchmark

Digital audiobooks, despite a small dip, serve as the comparative success story within the digital portfolio, holding onto year-to-date growth. This relative stability confirms that consumers are not abandoning digital consumption entirely but are instead aligning their format choice with the specific utility of that medium—i.e., convenience for passive listening over dedicated screen time for reading. This highlights that “digital reading” is not a monolith; it’s a spectrum of modes.. Find out more about E-book revenue decline September 2025 overview.

F. The Potential for Holiday Season Reversal

Given that September often precedes the crucial holiday shopping season, industry analysts will be keenly watching the final quarter reports. The strong print momentum provides a high baseline, but any meaningful recovery in e-book revenue would likely require a significant boost from new device sales or highly anticipated major releases during the end-of-year push. Will a blockbuster title force a digital return? We’ll be watching those Q4 figures closely.

G. The Importance of Comprehensive Data Aggregation

The initial context of this story highlights that these specific figures—provided by organizations like the Association of American Publishers (AAP) StatShot reports—offer a rare, clear metric in a complex industry. The continued dissemination of detailed, segmented revenue reports remains vital for any observer seeking to accurately gauge the health and transitional phase of the entire publishing enterprise.

H. Implications for Author Compensation and Platform Economics. Find out more about Hardcover book sales year-over-year surge definition guide.

Ultimately, the fluctuations in sales revenue across formats directly impact the economics for authors and the royalty structures of digital platforms. A sustained decline in the largest digital segment naturally leads to industry-wide discussions about the sustainability of author advances and the balance of power between content creators and the distribution gatekeepers. When a format shrinks, the pie for advances shrinks, too—a reality authors must factor into their long-term strategy for author compensation.

Key Takeaways: Navigating the New Format Reality

What should industry professionals, authors, and dedicated readers take away from the late 2025 data?

- Print is Not Dead, It’s Premium: Hardcovers and trade paperbacks are posting double-digit growth, proving that readers will pay a premium for a dedicated, distraction-free reading object.

- E-Books Need a Hard Reset: Four straight months of decline means the format is facing a systemic challenge that incremental updates won’t fix. Re-evaluating pricing or user experience is critical.. Find out more about Digital publishing format divergence Q3 2025 insights information.

- Audio is Contextual: Digital audio is stable year-to-date because it captures time readers *don’t* have for physical or screen reading—the commute, the gym, the kitchen. It’s a convenience play, not a replacement for deep reading.

- The Great Imbalance: The overall market success masks a severe format divide. Growth is being *fought for* by print, while digital formats (except audio) are shrinking their footprint.

Actionable Insight for Publishers: Stop treating print and digital as a zero-sum game. September shows that investing heavily in quality physical packaging for new releases is paying immediate dividends. Simultaneously, for e-books to recover, the industry needs to find a compelling new reason for purchase that outweighs the “free” perception many consumers hold for digital goods.

What are you seeing on your shelves or your screen? Are you buying more hardcovers, or are you leaning into the convenience of audiobooks? Drop a comment below and let’s discuss how these shifting reading habits are impacting your own reading life!